Progressive Insurance Quote: How To Save Money On Your Coverage

When it comes to shopping for car insurance, getting a quote is one of the first steps you’ll need to take. Progressive Insurance is one of the leading providers in the industry, known for its competitive rates and innovative policies. If you’re considering Progressive for your insurance needs, here’s everything you need to know about getting a quote.

1. What is a Progressive Insurance quote?

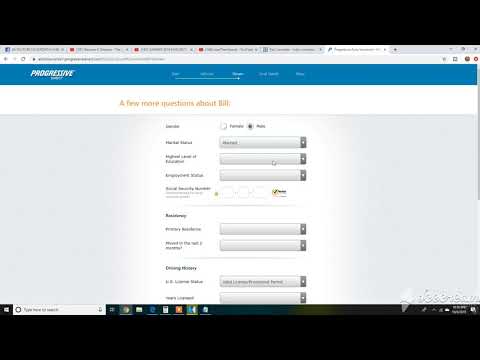

A Progressive Insurance quote is an estimate of how much you can expect to pay for your auto insurance coverage. When you request a quote from Progressive, you’ll provide some basic information about yourself, your driving history, and the vehicle you want to insure. Progressive will then use this information to calculate a personalized quote for you.

2. How do I get a quote from Progressive Insurance?

Getting a quote from Progressive Insurance is easy and can be done online, over the phone, or in person at a Progressive office. To get a quote online, simply visit the Progressive website and enter the required information. This may include details such as your name, address, date of birth, driver’s license number, and the make and model of your vehicle.

3. What factors affect my Progressive Insurance quote?

Several factors can influence the cost of your Progressive Insurance quote, including:

– Your driving record: If you have a history of accidents or traffic violations, you may pay more for insurance.

– Your age: Younger drivers typically pay more for insurance.

– The make and model of your vehicle: Some cars are more expensive to insure than others.

– Your location: Your zip code can affect your insurance rates.

– Your coverage options: The more coverage you choose, the higher your quote may be.

4. Can I save money on my Progressive Insurance quote?

Progressive offers several ways to save money on your insurance quote, including:

– Bundling policies: If you have multiple policies with Progressive, such as auto and homeowners insurance, you may qualify for a discount.

– Safe driving discounts: If you have a clean driving record, you may be eligible for a discount.

– Paying in full: Progressive offers discounts for customers who pay their annual premium upfront.

– Online discounts: By purchasing your policy online, you may be able to save money on your quote.

5. How long does it take to get a Progressive Insurance quote?

In most cases, you can get a Progressive Insurance quote in just a few minutes. By providing the required information online, Progressive can quickly calculate a personalized quote for you. If you prefer to speak with a representative over the phone or in person, the process may take a bit longer.

6. What should I do after I get my Progressive Insurance quote?

Once you’ve received your Progressive Insurance quote, take the time to review it carefully. Make sure all the information is accurate and that you understand what your policy covers. If you have any questions or want to make changes to your coverage, don’t hesitate to contact Progressive for assistance.

7. How often should I get a new Progressive Insurance quote?

It’s a good idea to get a new insurance quote from Progressive at least once a year. As your circumstances change and new discounts become available, you may be able to save money by switching to a new policy. By comparing quotes annually, you can ensure you’re getting the best coverage at the best price.

8. Are Progressive Insurance quotes accurate?

Progressive strives to provide accurate quotes based on the information you provide. However, keep in mind that your final premium may differ from the initial quote. Factors such as your credit score, claims history, and driving habits can all affect your actual insurance rate.

9. Can I get a Progressive Insurance quote if I have a poor driving record?

Yes, you can still get a Progressive Insurance quote even if you have a poor driving record. While you may pay more for insurance with a history of accidents or violations, Progressive offers competitive rates for drivers of all backgrounds. By comparing quotes from multiple providers, you can find the coverage that fits your needs and budget.

10. Is Progressive Insurance a good choice for me?

Progressive Insurance is a popular choice for many drivers due to its competitive rates, innovative policies, and excellent customer service. By getting a quote from Progressive and comparing it with other providers, you can determine if Progressive is the right fit for your insurance needs.

In conclusion, getting a quote from Progressive Insurance is a simple and straightforward process that can help you find the coverage you need at a price you can afford. By providing accurate information and taking advantage of available discounts, you can get a personalized quote that meets your needs. Whether you’re a new driver or looking to switch providers, consider getting a quote from Progressive Insurance today.

FAQs

Q: How do I get a quote from Progressive Insurance?

A: You can get a quote from Progressive Insurance online, over the phone, or in person at a local office.

Q: What factors affect my Progressive Insurance quote?

A: Factors that can affect your quote include your driving record, age, vehicle make and model, location, and coverage options.

Q: Can I save money on my Progressive Insurance quote?

A: Yes, by bundling policies, maintaining a clean driving record, paying in full, and purchasing online, you may be able to save money on your quote.

Q: How long does it take to get a Progressive Insurance quote?

A: In most cases, you can get a Progressive Insurance quote in just a few minutes online.

Q: How often should I get a new Progressive Insurance quote?

A: It’s recommended to get a new insurance quote from Progressive at least once a year to ensure you’re getting the best coverage at the best price.

Q: Are Progressive Insurance quotes accurate?

A: Progressive strives to provide accurate quotes based on the information you provide, but factors such as credit score and driving habits can affect your final premium.

Q: Can I get a Progressive Insurance quote if I have a poor driving record?

A: Yes, you can still get a quote from Progressive even with a poor driving record, though you may pay more for insurance.

Q: Is Progressive Insurance a good choice for me?

A: Progressive Insurance is a popular choice for many drivers due to its competitive rates, innovative policies, and excellent customer service. Consider getting a quote from Progressive to see if it’s the right fit for you.

Progressive insurance, Progressive car insurance, GEICO, GEICO quote, Auto insurance, Car insurance quotes, Farmers insurance, Cheap car insurance

Category: Top 84 Progressive Insurance Quote

Read more here: fi.activegaliano.org

Who is better Geico or Progressive?, Who typically has the cheapest insurance?, Who owns Progressive Insurance?, Is Progressive writing homeowners in Louisiana?, Why is Progressive so expensive?, Is Progressive the most expensive?, Who is most expensive car insurance?, What is the cheapest insurance in USA?, Which car insurance is best?, Is Progressive a US company?, Who did Progressive merge with?, Who is Progressive Insurance target audience?, Is Progressive in every state?, What is the best homeowners insurance?, Is Progressive home insurance leaving Florida?, Who is the most trusted insurance company?, Which is the best company for insurance?, What is the most trusted car insurance company?, Which company gives best insurance?

Link to this article: progressive insurance quote.